MoneyView Referral Code, MoneyView Personal Loan: Hello Folks, Today we will discuss about the Moneyview personal loan provider app. MoneyView is the personal loan provider app platform that offers instant personal loans with a fully digital process.

Sign up on the MoneyView app by using our MoneyView Referral Code/Links and get up to 100% off on processing fees and get instant approval of your digital loan amount of up to 10 lakh in your bank account within 10 minutes.

Contents

- 1 About MoneyView App

- 2 MoneyView Referral Code 2024 | Get Instant Personal Loan

- 3 Benefits Of The MoneyView App

- 4 Documents Needed For MoneyView Loan

- 5 MoneyView Loan Eligible Criteria

- 6 How To Signup On MoneyView App

- 7 MoneyView Customer Care Details

- 8 FAQ About MoneyView Personal Loan App

- 9 Final Word On MoneyView Loan App

About MoneyView App

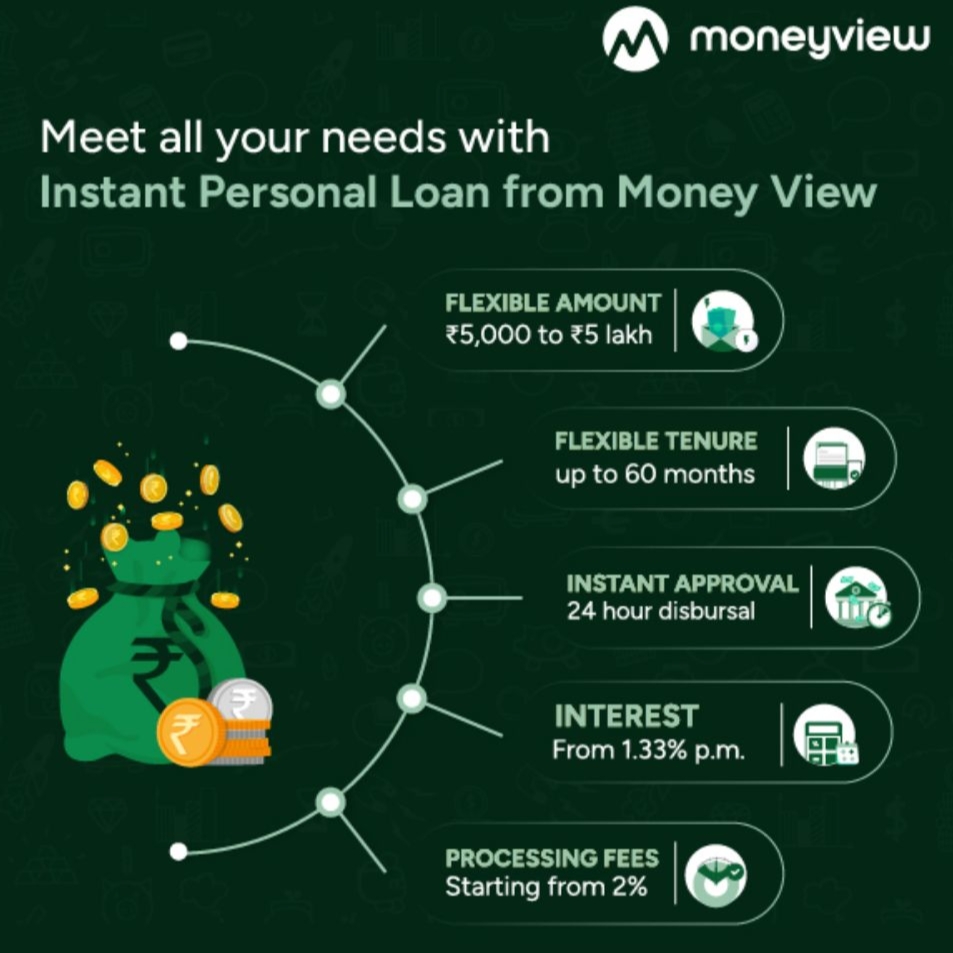

Moneyview is a digital platform run by WhizDM Innovations Pvt. Ltd. that offers Instant Personal Loans at 1.33% per month or (16% p.a.) onwards for loan amounts of up to 10 lakh and for tenures of up to 5 years. Personal loan applicants can check their eligibility within 2 minutes and can get their loan amount disbursed within 24 hours of approval. The entire process from loan application to disbursement is completely digital. Moneyview has developed an alternative credit-scoring model to help applicants with low credit scores get personal loans.

Also Read About:

MoneyView Referral Code 2024 | Get Instant Personal Loan

| App Name | MoneyView Personal Loan |

| MoneyView Referral Code | Nil |

| Referral Benefits | 1.5% Commission |

| Signup Benefits | Get 100% Off On Processing Fees |

| MoneyView Personal Loan | Apply Now |

Benefits Of The MoneyView App

- Collateral-free loans and No hidden charges

- Processing fee – Starting from 2% of the approved loan amount

- Interest rates start from 1.33% per month

- 100% Paperless application process

- Long repayment tenure of up to 60 months

- Loans from Rs. 5000 to Rs. 5 Lakhs

Documents Needed For MoneyView Loan

- Aadhaar Card

- PAN Card

- Salary Slip

- Bank Statement

MoneyView Loan Eligible Criteria

- Minimum salary in hand should be more than ₹15,000 per month

- CIBIL score of at least 600 or Experian score of at least 650

- The salary should be credited directly to your bank account

- Age should be lies between 21 to 57 years

How To Signup On MoneyView App

- First, Visit the MoneyView website by clicking here.

- Then, please Register with your mobile number and verify it with OTP.

- Then, enter your personal details according to your documents.

- Then, select the purpose of availing loan.

- Now enter the PAN card and Aadhar card details.

- Then, select the Loan plan and proceed with the KYC.

- Now complete the KYC and verify your income proof.

- Your loan has been approved successfully.

- Now you can immediately withdraw in your bank.

MoneyView Customer Care Details

MoneyView Customer Care Contact Number: 080 6939 0476

MoneyView Customer Care Email ID: care@moneyview.in

FAQ About MoneyView Personal Loan App

Is The MoneyView Loan App Safe?

Yes, Moneyview’s security systems are designed to be in line with those of the best banks in the country. Rest assured knowing that all your data is safe and secure because MoneyView uses 256-bit data encryption for data management.

Is The MoneyView Loan App RBI Approved?

Yes, Moneyview is a digital platform run by WhizDM Innovations Pvt. Ltd, which is approved by the RBI to offer personal loans. So, it is a fully safe and trusted loan provider app.

What Is the Rate Of Interest Charged By The MoneyView App?

The rate of interest charged by moneyview is very low, starting from 1.33% per month and going up to 2% per month depending on the applicant’s profile.

What is the Maximum Limit of the MoneyView Loan Amount?

MoneyView gives personal loans in the range between Rs. 5000 to Rs. 10 Lakhs according to your cibil score and repayment. You can customize your loan amount as per your needs because sometimes he offers very high amounts of money if your Cibil score is good you decrease the loan amount if you do not need that much amount.

What Is MoneyView Referral Code?

Currently, the MoneyView Referral Code option is not working properly but to get the referral benefits you can sign up on the Moneyview app by using our MoneyView Referral Link by clicking here.

Final Word On MoneyView Loan App

In this article, We discussed everything about the MoneyView personal loan app such as how to sign up for the moneyview personal loan app, the MoneyView loan application process, the eligibility criteria for the Moneyview loan, etc. If still you have any doubts about the moneyview app then you can comment on your doubts we will try to give the relevant answers to your doubts.

One last thing if you need a personal loan you can try this app because it is the most famous and trusted loan app available in India that offers collateral-free loans with Zero hidden charges at 1.33% monthly interest. Don’t forget the sign up on the MoneyView app by using our MoneyView Referral Code/Link to get a discount on processing fees.